How to Send Money to Paypal Account in India

PayPal has been one of the most popular and oldest online wallets platforms. Founded in the US, PayPal has helped individuals, freelancers and businesses send, transfer, pay and request money with the PayPal wallet.

| ⚠️ Not all of PayPal's features are available in India. And one of the most important features- adding money to a PayPal wallet or balance- can't be done by Indian residents at the moment. |

|---|

Actually, any sort of personal payments to friends or family members aren't supported in India for PayPal.

On top of that, while PayPal may have led the charge in online wallets, it's services can be weighed down by its wallet structure and fees. PayPal users typically find higher fees attached with currency conversions, payments and exchange rates, than with newer and more modern global money transfer services.

| Wise lets you receive money directly to your local Indian rupee bank account from abroad 💸 |

|---|

Open your free Wise account now

But let's take a deep dive into how PayPal operates in India and if it could work for you.

Currently in India, you can access the PayPal worldwide shopping mall where you can make purchases from brands that are on the PayPal platform.

You can do this by opening a PayPal account with a valid Indian debit or credit card. Then as you shop, you can make the payments with the linked card. But make sure you have allowed for international transactions with your card and checked your spending limit with your domestic Indian bank.

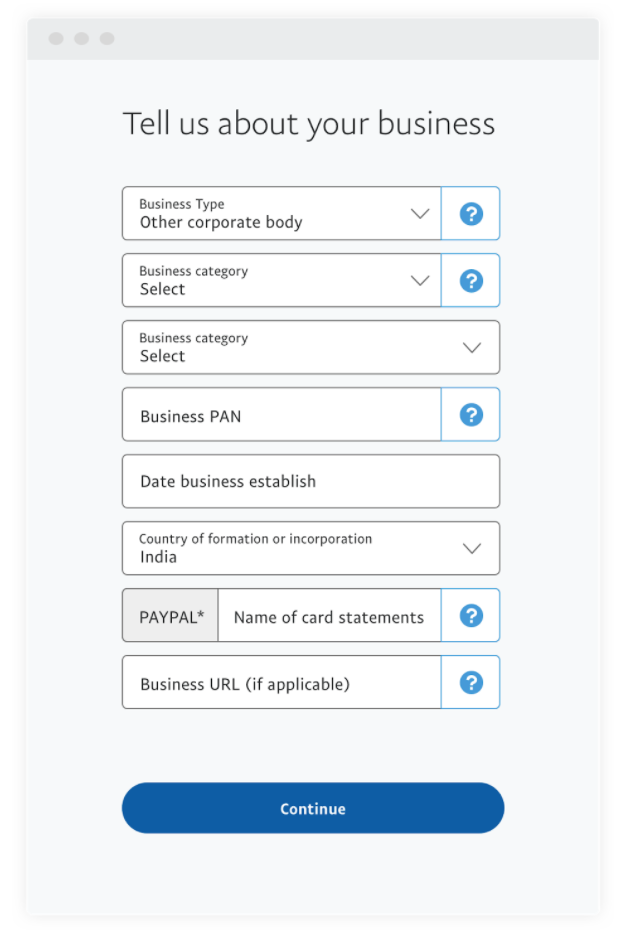

If you are a freelancer or business, you can open a PayPal account to receive payments from abroad. To do so, you may be required to provide:

- Your individual PAN

- Business PAN

- Legal name of the business

- Business owner contact information

You will also need to verify your PayPal business account by submitting additional documents.

Now that you have set up your PayPal account, how do you go about connecting or transferring money? Don't worry, our next section has you covered.

How to transfer money from PayTM to PayPal

It is not possible to transfer money directly from PayTM to PayPal. PayPal India does not allow for the funding of personal wallets in total, including from PayTM. And so as an individual if you want to make a purchase on the PayPal shopping mall, it would have to be done with a linked debit or credit card.

And in the reverse, if you have gotten paid in PayPal, there is no way to directly transfer the funds to a PayTM wallet.

To move money to a PayTM wallet, you would have to move the proceeds from your PayPal wallet to your linked bank account, and then move the funds again to your PayTM wallet from your bank. ¹

How to add money to PayPal from debit/ credit card

You will not be able to add money to a PayPal wallet as an individual, business or freelancer in India.

But you can link your debit or credit card to your account for when you shop through PayPal.

To do so, first, make sure you have a PayPal account. You can sign up for PayPal for online for free. The sign up will require you to submit your mobile number for verification. ²

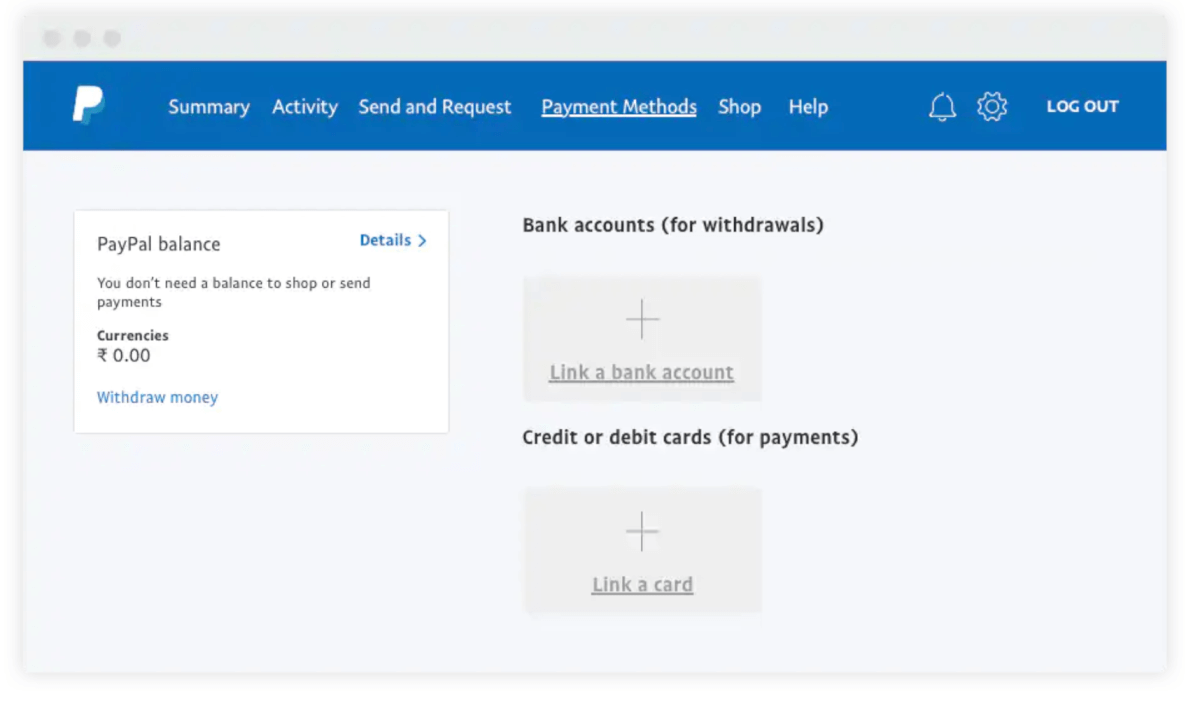

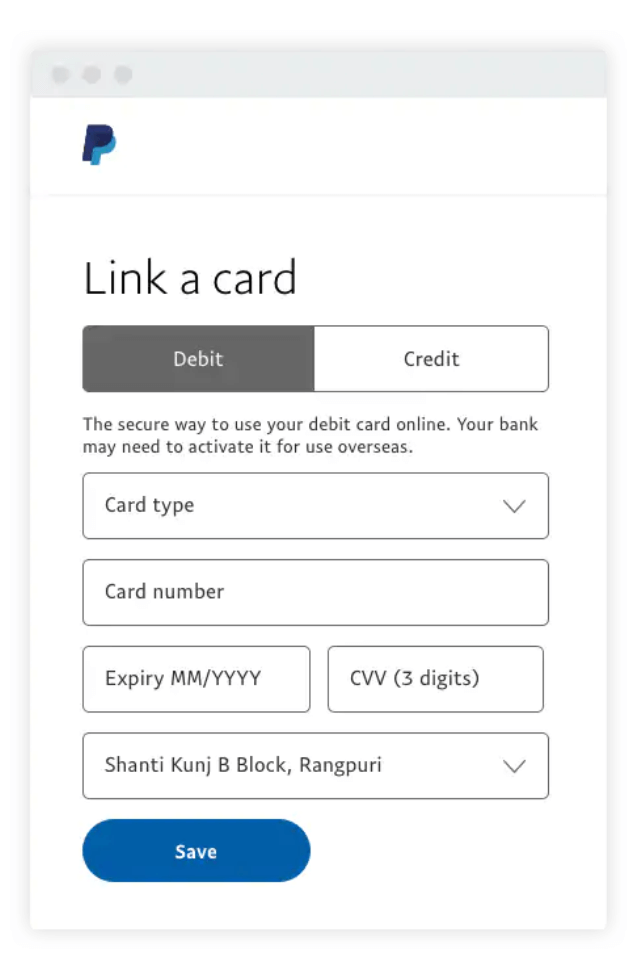

Once you are signed up and logged in, here are the steps you need to take³:

- Go to your personal account details

- Find the 'Payment Methods' tab and then 'Credit and debit cards (for payments)'

- Click on 'Link a card'

- Choose either debit or credit card, and enter in your respective card details.

- Click on Save

- You'll be taken to your bank's website for verification, and enter in the OTP sent to your linked phone number

- You're done

Your debit or credit card will now be linked to your personal account and will be saved, so it can be easily accessed and used when you shop.

But make sure that your card and bank in India allows for international and online payments, or your payment may get rejected. You can have up to 8 cards linked to your PayPal account at one time. ⁴

And as a customer using PayPal, you will not be charged any fees.

But it is a different story for a small business in India. You will be charged a fee for using PayPal as a payment gateway online for domestic and international transactions⁵:

| Type of transaction | PayPal Fee |

|---|---|

| Standard Domestic Transactions | 3% + ₹3 |

| Domestic Transaction through Rupay, UPI, UPI QR Code, or BHIM UPI | 2.50% + ₹3 |

| International transaction | 4.40% + Fixed fee depending on currency |

As of 26 January, 2021

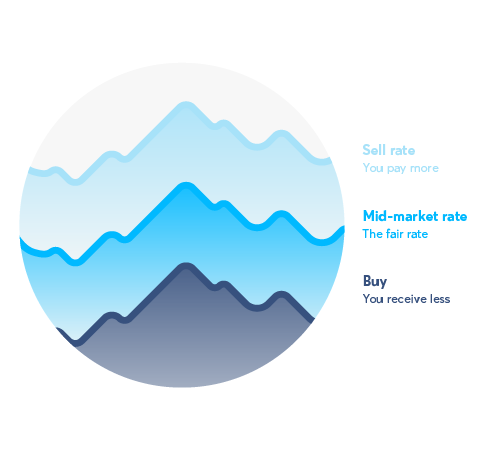

On top of the currency specific fixed fee for international transactions, PayPal additionally charges an additional conversion fee for your payments that is put on top of the exchange rate.

So any money you receive as payment, may be subjected to most if not all the fees listed above, before you receive the money in your local bank account.

How to transfer money from bank account to PayPal instantly

For any individual or business, you can not move money into a PayPal account or top-up your wallet in India.

Instead, you can link your bank account to your PayPal account to make payments for shopping and to withdraw money to your local bank account as an individual. Or receive payments as a business.

As an individual, your PayPal account will also be allowed to be linked to a debit or credit card which can be used at the time of purchase through the PayPal payment gateway.

If you're a merchant or business, you will be asked to link your bank account to your account in order to process payments. Keep in mind that to confirm your bank account details will require a process which takes 4-6 business days once started.

Make sure the name on your PayPal account matches the name on your bank account. You can withdraw any money you receive as payment to your local Indian bank account for free.

India's regulation requires daily auto-withdrawal from your PayPal account to your bank account in India. So your balance will be zero-ed out at the end of every day from your PayPal account. ⁶

Save money by using Wise for international payments

Using an online wallet can get complicated quickly. Make things easier on yourself with the simple to use Wise.

With Wise, you can send and receive money in India often faster and cheaper than other money transfer services out there.

If you are abroad and sending money to India, the only fee you will have to pay is one low transfer fee. Same goes for clients you have abroad. One transfer fee, and that's it.

Recipients in India will never have to pay to receive money. And the money is deposited directly to the local Indian bank account. No middle man or other wallet to worry about when receiving money from abroad.

And, with Wise you always get the real exchange rate. That is the same exchange rate the banks use themselves and that you see on Google. So without any mark ups or conversion fees, you get to save money on every payment or transfer- and so do your clients or customers.

| 1. Sign up with your email online or Wise Android/ iOS app for free 2. Select currency and choose how much you want to send overseas 3. Check the transfer fee, exchange rate and delivery time for your transfer 3. Add the bank details of where the money is going 4. Complete your transfer and make the payment. That's it. |

|---|

Open your free Wise account now

And if you have clients or business abroad, you can help them save money by using Wise for your payments. You can provide them your local India bank details and you will be notified when they have sent their payment through Wise. And in most popular routes to India, you can have the money within 1 day or in some cases, the hour.

So join the over 8 million customers around the world that use Wise to make global payments cheaper, easier and faster.

Sources

This publication is provided for general information purposes only and is not intended to cover every aspect of the topics with which it deals. It is not intended to amount to advice on which you should rely. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content in this publication. The information in this publication does not constitute legal, tax or other professional advice from TransferWise Limited or its affiliates. Prior results do not guarantee a similar outcome. We make no representations, warranties or guarantees, whether express or implied, that the content in the publication is accurate, complete or up to date.

How to Send Money to Paypal Account in India

Source: https://wise.com/in/blog/how-to-add-money-in-paypal

0 Response to "How to Send Money to Paypal Account in India"

Post a Comment